We often view tax law as a rigid, unchanging set of rules. A regulation is written, and businesses must contort their operations to fit within its lines. But what happens when the government’s interpretation of those lines stretches too far? A landmark ruling from Kenya’s Supreme Court has delivered a powerful answer. It reminds us that even the taxman must color inside the legal lines, and that clarity in law benefits everyone. Let us examine the case that has reshaped the financial landscape.

- The Dispute That Climbed to the Top

The story began over a decade ago with a routine tax audit. The Commissioner for Domestic Taxes examined Barclays Bank of Kenya, now Absa Bank Kenya PLC. The audit focused on specific payments the bank made in the normal course of its card business.

The tax authority took a novel position. It argued that fees paid by the bank to global card companies like Mastercard were “royalties.” Separately, it claimed that “interchange fees”—payments between banks when a customer uses a card—were “management or professional fees.” This classification was critical. If true, these payments would be subject to withholding tax, creating a significant new liability for the bank and, by extension, the entire industry.

The bank disagreed. This was not a dispute about evading tax, but about correct categorization. What were these payments, truly? The case traveled through the tribunal system, reached the High Court, and then the Court of Appeal. At each stage, the stakes and the confusion grew. Finally, the Supreme Court admitted the appeal, recognizing it presented “matters of general public importance” for the country’s banking and revenue systems. This was no longer just about Absa; it was about the rule of law for an entire sector.

- The Supreme Court’s Clear Verdict

In a definitive judgment, the Supreme Court cut through the complexity. It went back to the foundational text: the definitions in the Income Tax Act. The Court’s analysis was methodical and rooted in statutory interpretation.

First, on payments to card companies: The Court concluded these fees are not royalties. Royalties typically involve payments for the use of intellectual property or a secret formula. The fees paid for accessing a card payment network, the Court found, are fundamentally different. They are fees for a service, not for a licensed right. Therefore, they are not liable for withholding tax under the royalty provision.

Second, on interchange fees between banks: The Court concluded these are not management or professional fees. These fees are part of a standardized, automated settlement process between financial institutions for a completed transaction. They are not payments for consultancy, advice, or managerial services. They are operational settlements. Thus, they also fall outside the scope of withholding tax.

The Court’s message was about legal precision. The tax authority’s attempt to expand the definitions of “royalties” and “management fees” beyond their ordinary meaning was an overreach. The law must be applied as written, not as imagined.

- The Directives from this Ruling

This judgment provides several clear takeaways for businesses, the tax authority, and the public.

- Takeaway One: The Plain Meaning of the Law Prevails. Authorities cannot impose tax by creatively redefining common commercial terms. A fee must fit the legal definition of a taxable category. When the law says “royalty,” it means a payment for a specific type of intellectual property right, not a catch-all term for international payments. This protects businesses from arbitrary and unpredictable tax assessments.

- Takeaway Two: Protracted Litigation Can Serve the Public Good. The Court made a notable decision on costs. While the bank won the appeal, the Court ordered each party to bear its own costs. Why? Because this “protracted dispute” resulted in a “final clarification of the law.” This acknowledges that challenging unclear tax positions is not mere obstruction. When a case resolves fundamental uncertainty for an entire industry, it serves the national interest by providing clarity, stability, and a fair framework for future compliance.

- Takeaway Three: Clarity Benefits the Entire System. The Court stated this clarity would serve “the Country’s revenue collection, financial and banking system, and the tax paying public.” Certainty is the bedrock of investment and growth. Businesses can now structure transactions without fear of retrospective re-categorization. The Kenya Revenue Authority can focus its efforts on legitimate claims within clear boundaries. This fosters a more cooperative, less adversarial relationship between the regulator and the regulated.

- A Message for Regulatory Ambition

This case, like the governance and land rulings before it, carries a message for powerful state organs. Ambition must be tempered by the text. The desire to increase revenue cannot justify stretching legal definitions beyond their breaking point.

The Supreme Court’s role as the final arbiter is to check this overreach. By demanding strict adherence to statutory definitions, it ensures predictability and fairness. This ruling reinforces that the correct path to increased revenue is through clear, well-defined laws passed by Parliament, not through aggressive reinterpretation by the administration.

The Final Point: Certainty is the Best Policy

The unifying principle across the Supreme Court’s tax ruling, the land cases, and the governance tribunals is the necessity of certainty and active stewardship.

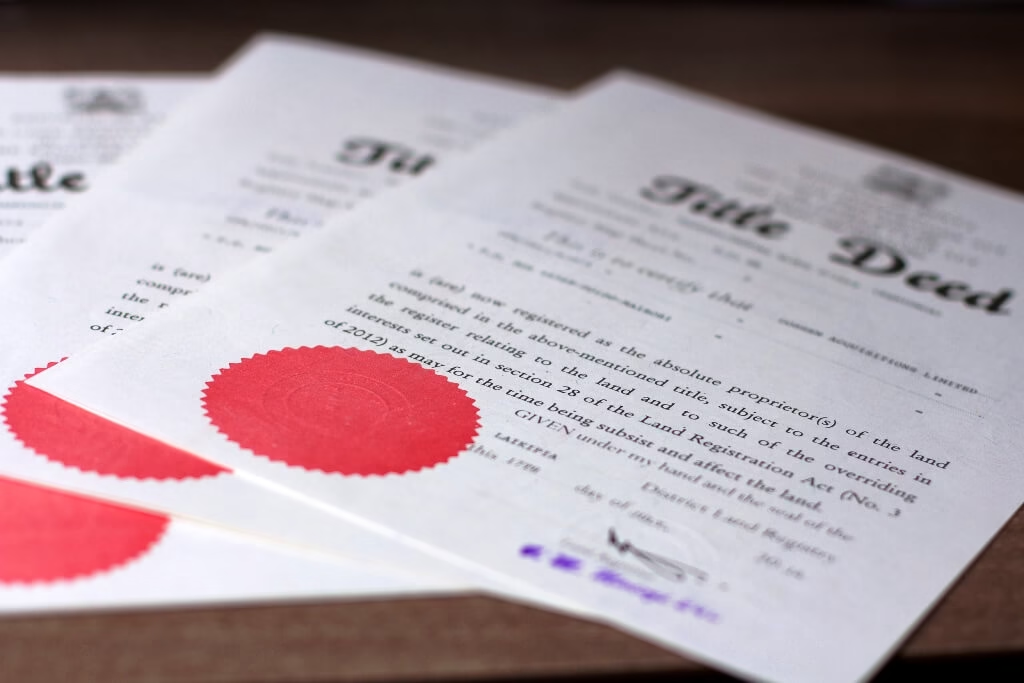

In tax, certainty means applying the law as written. In land, it means the law will recognize the active caretaker over the passive holder of a paper title. In governance, it means boards must actively demonstrate their compliance, not just file it away.

Leave a Reply