A landmark judgment from the High Court in Nairobi has dramatically reshaped the financial future for millions of Kenyans. In a case pitting three loan beneficiaries against the Higher Education Loans Board (HELB), Justice A. Mabeya delivered a ruling that extends a crucial financial protection—the in duplum rule—to student loans. This decision is not just a legal technicality; it is a profound intervention in the socio-economic landscape of Kenya, offering relief from a cycle of debt that has trapped generations of graduates.

Here is a detailed breakdown of the case, the Court’s decisive reasoning, and the vital lessons it holds for public institutions, policymakers, and every Kenyan who has ever relied on a loan to pursue their dreams.

1. The Debt Trap That Sparked a Legal Revolution

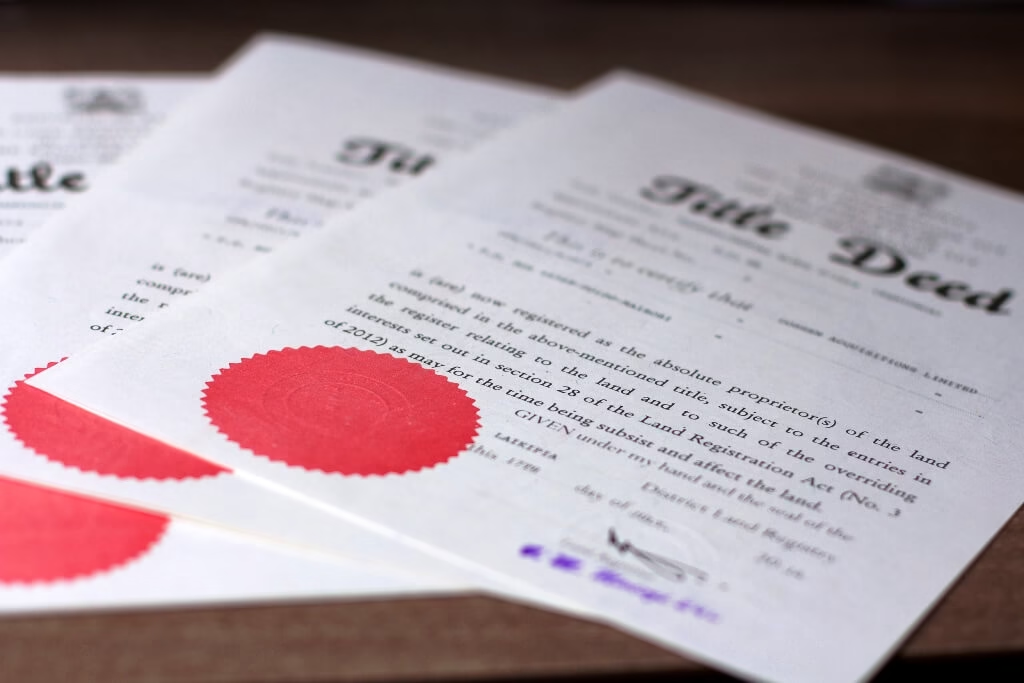

The petitioners, Anne J. Mugure, Davis Nguthu, and Wangui Wachira, were among the countless beneficiaries of HELB loans designed to finance university education. After completing their studies, they, like many others, entered a job market offering scarce opportunities. As they struggled to find employment, their loans continued to accrue interest and penalties.

Their central grievance was stark: HELB had been charging compounding interest and monthly fines on their loans, causing the total amount owed to balloon far beyond double the original principal sum. This made the debt effectively impossible to repay, transforming a lifeline for education into a lifelong financial burden.

Feeling aggrieved and trapped, they filed a constitutional petition. They argued that HELB’s practices violated their socio-economic rights and amounted to discrimination. They sought a declaration that the infamous in duplum rule, which caps bank loan repayments, must also apply to HELB.

2. What the Court Decided

The Court’s judgment was a comprehensive victory for the petitioners and a radical reinterpretation of consumer protection law in Kenya.

a) The In Duplum Rule Applies to HELB

This was the core legal breakthrough. HELB, and likely many other non-bank lenders, argued that the in duplum rule under Section 44A of the Banking Act was a privilege reserved only for borrowers from commercial banks. The Court resoundingly rejected this narrow view.

Justice Mabeya held that the in duplum rule is a principle of public interest, not a narrow technical statute. Its purpose is to tame the appetite of lenders and protect vulnerable borrowers from exorbitant, never-ending interest. The Court reasoned that there was no logical or legal basis to withhold this fundamental protection from HELB loanees, who are often students from financially challenged backgrounds and are even more vulnerable than typical bank customers.

b) HELB’s Practices Constituted Discrimination

The Court found that by subjecting student borrowers to unlimited interest and penalties while bank borrowers enjoyed statutory protection, HELB was violating Article 27 of the Constitution on equality and freedom from discrimination. The petitioners were being unfairly penalized simply because they borrowed from a state education fund rather than a commercial bank. This created an unjust, two-tier system of borrower rights.

c) Socio-Economic and Consumer Rights Were Violated

The judgment powerfully linked financial practice to human rights. The Court found that HELB’s actions violated the petitioners’ right to education (Article 43(1)(f)) and their right to the highest attainable standard of health (Article 43(1)(e)), as crushing debt directly impacts a person’s well-being and life choices. Furthermore, it breached their rights as consumers to fair and honest treatment (Article 46).

d) Reading the Law to Uphold Justice

The Court employed a creative and practical remedy. Rather than striking down Section 15(2) of the HELB Act—which mandates fines for late repayment—it chose to “read into” the section the in duplum rule. This means the law stands, but it must now be interpreted and applied with a crucial caveat: once the total interest and penalties reach the original principal amount (making the total owed double the principal), all further accruals must cease.

e) A Call for Responsibility on Both Sides

While ruling strongly in the petitioners’ favor, the Court also noted that the obligation to repay the principal debt remained. With the protection of the in duplum rule now firmly in place, it was time for beneficiaries to engage with HELB and honor their debts up to the capped limit.

3 What Public Institutions, Lenders, and Borrowers Must Learn

This judgment is a masterclass in applying constitutional principles to everyday economic life. Its lessons are urgent and wide-ranging.

Public Interest Trumps Legal Technicalities

The most significant takeaway is that courts will look at the spirit and purpose of a law designed for public protection. The in duplum rule was created to prevent predatory lending. The Court refused to let a technicality about which Act it was written in defeat that core purpose. This principle signals that other consumer protections may also be extended by courts beyond their original statutory boundaries if justice requires it.

State Agencies Must Lead by Example on Fairness

HELB is a state-funded body with a noble social mandate: to broaden access to education. The Court found it contradictory and unlawful for such an entity to employ recovery tactics harsher than those used by profit-driven banks. State institutions must be the foremost champions of fairness, dignity, and constitutional rights in all their operations, including debt collection. Their role is to uplift, not entrap, citizens.

Debt Can Be a Human Rights Issue

This case elegantly demonstrates how unsustainable debt violates socio-economic rights. When a graduate cannot afford healthcare, housing, or a family because their student loan has spiraled out of control, their right to dignity and a decent life is directly infringed. Policymakers and institutions must view credit and debt management through a human rights lens, not just a financial one.

The Law is a Living Tool for Social Justice

The Court’s remedy— “reading in” the in duplum rule—is a powerful judicial tool. It fixes an unjust law without causing the disruption of striking it down entirely. This approach allows courts to update outdated legislation to align with constitutional values, providing immediate relief while nudging the legislature to enact more comprehensive reforms.

A Wake-Up Call for All Non-Bank Lenders

The ruling’s logic does not stop at HELB. Any institution lending money—microfinance banks, Sacco societies, digital credit providers—must now seriously consider if their practices could be challenged under the same public interest principle. A wave of litigation may follow, demanding similar protections for other classes of vulnerable borrowers.

Conclusion: Breaking the Chain

The Mugure v. HELB judgment is more than a legal precedent; it is a societal recalibration. It breaks a chain of debt that has held back countless Kenyan families. It reaffirms that the law, guided by the Constitution, exists to protect the vulnerable from the powerful.

For current and future students, it offers a shield. For HELB and similar bodies, it is a mandate to reform. For the legal community, it is a brilliant example of transformative constitutionalism in action. This case proves that when justice is framed not just as a procedure, but as a pathway to human dignity, it can change the course of a nation’s future.

Leave a Reply